Paycheck calculator atlanta

The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and. Calculating your Georgia state income tax is similar to the steps we listed on our Federal paycheck calculator.

Paycheck Calculator Take Home Pay Calculator

Georgia Paycheck Calculator Use ADPs Georgia Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees.

. In a few easy steps you can create your own paystubs and have them sent to your email. Read reviews on the premier Paycheck Tools in the industry. Free Unbiased Reviews Top Picks.

Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. Compare cost of living in Atlanta with factors like salaries housing expenses groceries utilities and more. Payroll So Easy You Can Set It Up Run It Yourself.

Taxable Income USD Tax Rate. Ad Compare This Years Top 5 Free Payroll Software. Atlanta Georgias cost of living is 5 higher than the national average.

Georgia Hourly Paycheck Calculator. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. All you have to do.

We use the most recent and accurate information. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. Luckily our Georgia payroll calculator eliminates all the extra clutter associated with calculating payroll so your administrative duties wont be quite as dull.

Figure out your filing status work out your adjusted gross income. Ad Compare This Years Top 5 Free Payroll Software. For 2022 tax year.

Georgia Salary Paycheck Calculator. Ad Create professional looking paystubs. Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Georgia.

Simply enter their federal and state W-4 information as. Those that are filing as single see tax rates that range from 1 to 575. It can also be used to help fill steps 3 and 4 of a W-4 form.

For example if an employee earns 1500 per week the individuals annual. The tax brackets are different depending on your filing status. So if you earn 10 an hour enter 10 into the salary input and select Hourly Optional Select an alternate state the.

Ad See the Paycheck Tools your competitors are already using - Start Now. Free Unbiased Reviews Top Picks. Ad Get Started Today with 2 Months Free.

All Services Backed by Tax Guarantee. Get Your Quote Today with SurePayroll. Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Georgia.

Just enter the wages tax withholdings and. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. Enter your salary or wages then choose the frequency at which you are paid.

Calculate your Georgia net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4. Important Note on Calculator. Well do the math for youall you need to do is enter.

1

Equivalent Salary Calculator By City Neil Kakkar

Paycheck Calculator Take Home Pay Calculator

Georgia Paycheck Calculator 2022 With Income Tax Brackets Investomatica

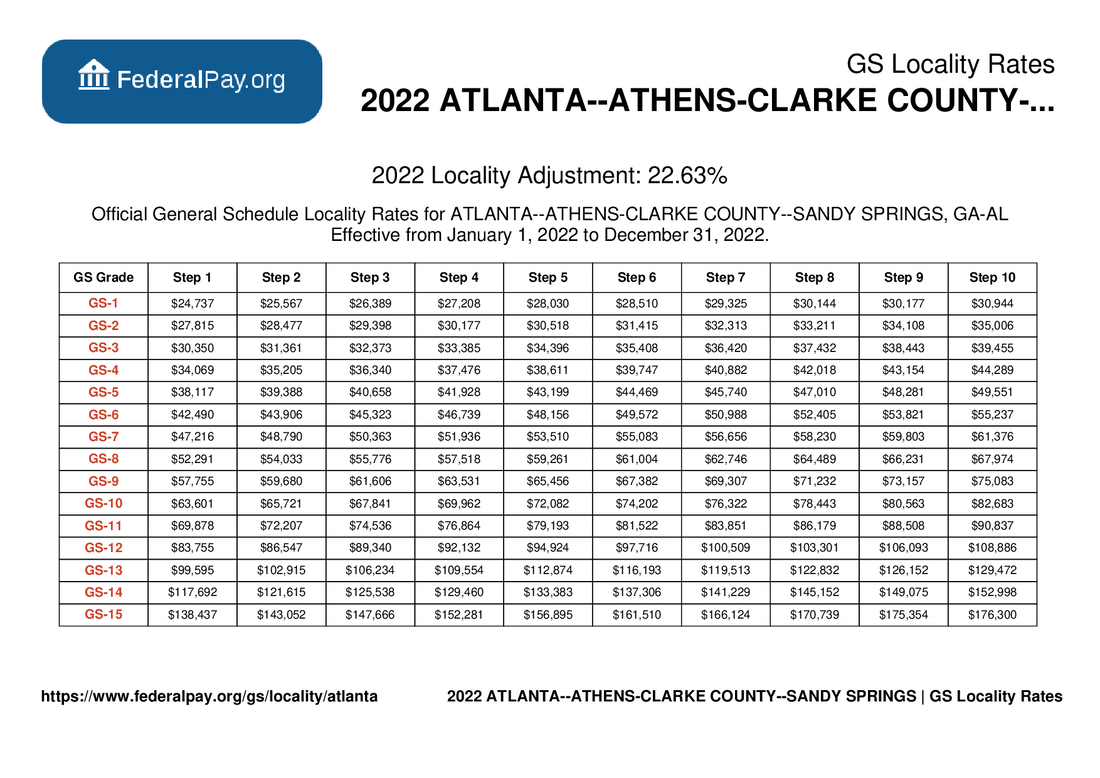

Atlanta Pay Locality General Schedule Pay Areas

![]()

Free Georgia Payroll Calculator 2022 Ga Tax Rates Onpay

Take Home Pay

General Schedule Gs Base Pay Scale For 2022

1

Paycheck Deductions

Salary Paycheck Calculator How Do You Calculate Your Take Home Pay Marca

Salary Overtime Calculator Calculate Time And A Half Double Time Wages

Georgia Paycheck Calculator Smartasset

![]()

Georgia Paycheck Calculator 2022 With Income Tax Brackets Investomatica

Georgia Paycheck Calculator Smartasset

Paycheck Calculator Take Home Pay Calculator

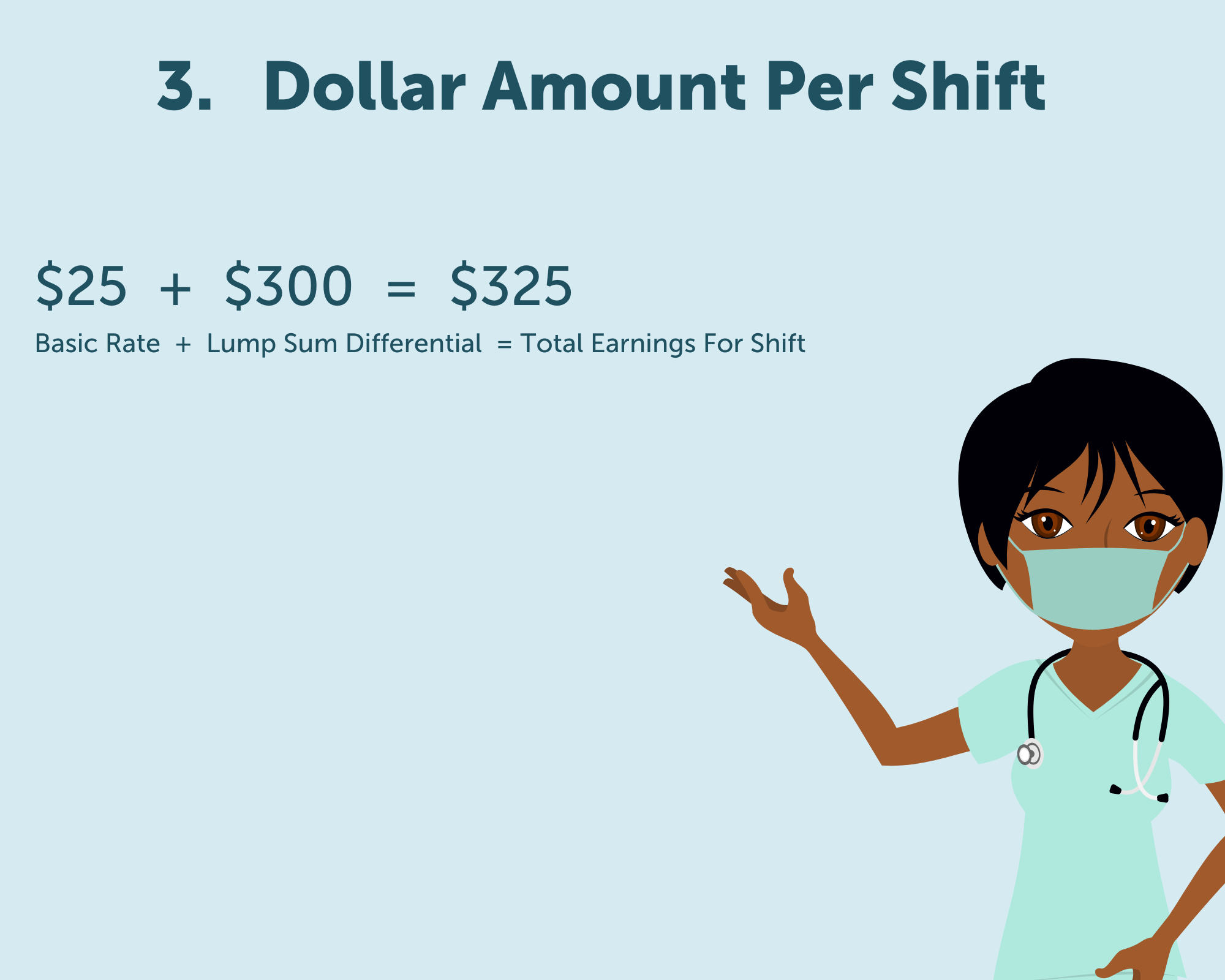

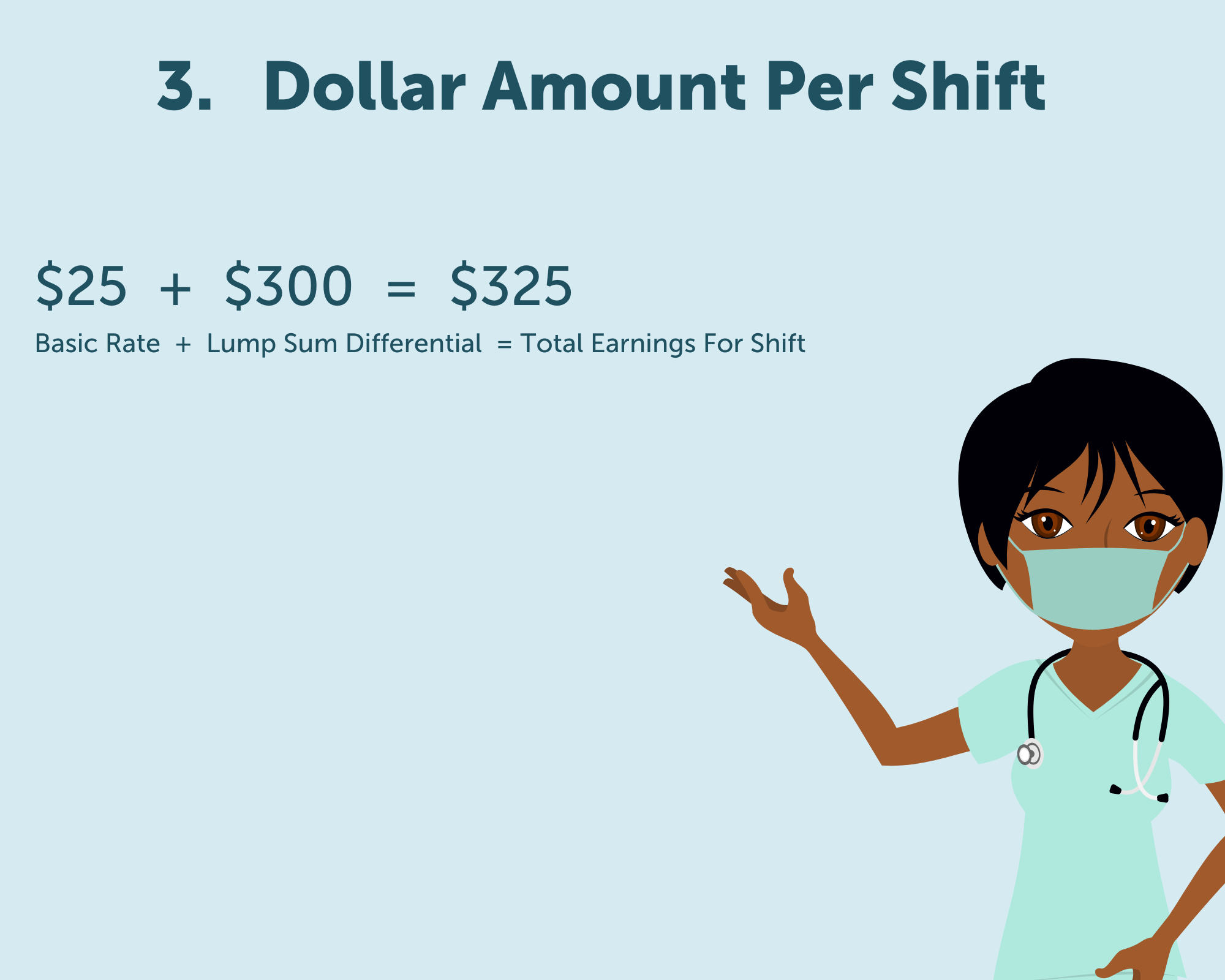

Shift Differential Pay Other Healthcare Payments Explained Aps Payroll